Description

Global Mining Drilling Services Market Size was worth USD 3.04 Billion in 2023 and it is expected to grow to USD 4.87 Billion in 2030 with a CAGR of 6.60 % in the 2023-2030 period.

Global Mining Drilling Services Market: Overview

Drilling services include drilling work carried out on contract basis for numerous mining customer bases, operating across the wide ranges of commodities such as coal, metals, and others. Various types of drilling services are surface drilling, underground coring, and others. Furthermore, the drilling services’ agreements are typically carried out through a tender process. Drilling service providers quote an extensive costing process that guarantees that the projects are well planned and taken into consideration the geography, geology, time-frame, and others. Drilling is a significant component of the mining industry and used for various purposes such as body characterization, surface & underground blast hole drilling, underground roof bolting & cabling, dewatering, and others. There are numerous advancements in the drilling technology such as development of global positioning system (GPS), wireless communications, sensors, and others. While there are numerous things at development stage such as automated drill rigs and battery-operated drill rigs. An automated drilling rig provides the mining industry a rapid solution for excavation operation. Furthermore, battery-operated drill rigs have potential of drilling blast patterns in short period of time as well as accurately than any human-operated machines. Some of the advantages of battery-operated drill rigs are no harmful exhaust fumes, less maintenance costs, and if equipped with chargers or exchangeable batteries would offer support for long-working hours of continuous mining operations. Drilling technology has evolved and served the needs of the industry.

Global Mining Drilling Services Market: Covid 19 Impact:

The COVID-19 pandemic had a significant impact on the global mining drilling services market, causing a decline in demand and revenue. The pandemic disrupted supply chains, reduced mining activities, and led to labor shortages, all of which contributed to a challenging market environment for mining drilling services companies. Reduced demand for drilling services: The pandemic caused a decline in global mining activities, leading to a reduced demand for drilling services. This was due to factors such as lower commodity prices, reduced production quotas, and labor shortages. Supply chain disruptions: The pandemic disrupted global supply chains, making it difficult for mining drilling services companies to procure necessary equipment and materials. This increased costs and led to delays in project execution. Labor shortages: The pandemic caused labor shortages in many parts of the world, including in mining regions. This made it difficult for mining drilling services companies to find and retain skilled workers.

Global Mining Drilling Services Market: Key Insights

- The Global Mining Drilling Services Market Size was worth around US$ 3.04 Billion in 2022 and is predicted to grow with a CAGR of Roughly 6.60 % between 2023 and 2030.

- The increasing demand for minerals and metals is the primary driver of the market.

- The growing adoption of automation and technological advancements is creating new opportunities for market growth.

- The Asia Pacific region is expected to be the fastest-growing market, followed by North America and Europe.

- The environmental impact of mining is a major challenge for the industry.

- The global mining drilling services market is expected to grow at a healthy pace in the coming years, driven by the factors mentioned above.

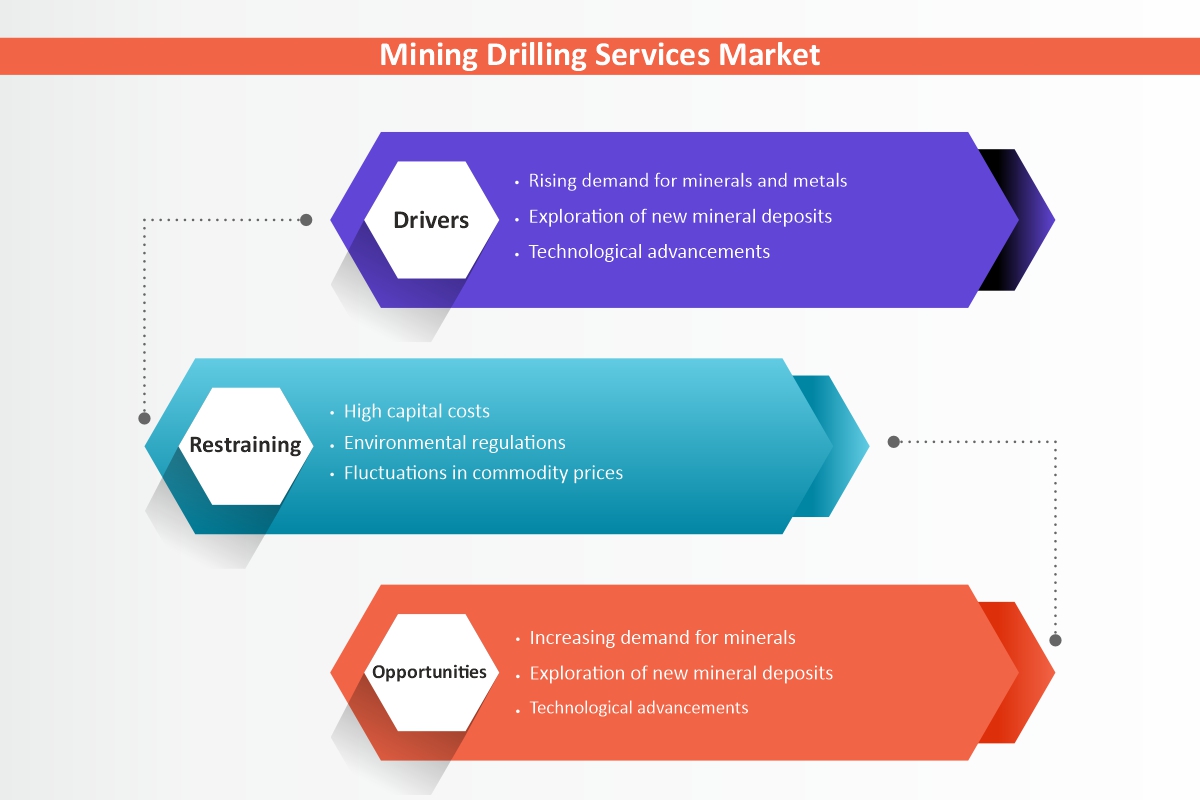

Global Mining Drilling Services Market: Growth Drivers

-

Rising demand for minerals and metals:

The increasing demand for minerals and metals, driven by urbanization, industrialization, and the growth of renewable energy technologies, is a key growth driver for the mining drilling services market. Minerals and metals are essential raw materials for a wide range of products, including construction materials, electronics, and batteries.

-

Exploration of new mineral deposits:

The depletion of existing mineral deposits is forcing mining companies to explore new deposits, often in remote and challenging locations. This is increasing the demand for drilling services to identify and assess the potential of these new deposits.

-

Technological advancements:

Technological advancements in drilling equipment and techniques are making drilling operations more efficient and productive. This is reducing costs and improving the accuracy of drilling results.

Global Mining Drilling Services Market: Restraints

-

High capital costs:

Mining drilling services require significant upfront investment in equipment and technology. This can be a barrier to entry for new companies and can also make it difficult for existing companies to expand their operations.

-

Environmental regulations:

The mining industry is subject to increasingly stringent environmental regulations. This can increase the costs of mining drilling services, as companies must invest in equipment and technologies that meet these regulations.

-

Fluctuations in commodity prices:

The demand for mining drilling services is closely tied to the price of commodities. When commodity prices are low, miners are less likely to invest in exploration and development, which reduces the demand for drilling services.

Global Mining Drilling Services Market: Opportunities

-

Increasing demand for minerals:

The world is becoming increasingly reliant on minerals for a variety of purposes, including the production of electronics, renewable energy technologies, and infrastructure. This is driving demand for mining activities, and therefore for drilling services.

-

Exploration of new mineral deposits:

As the demand for minerals increases, mining companies are exploring new areas for potential deposits. This is leading to an increase in drilling activity in new and remote locations.

-

Technological advancements:

Drilling technologies are becoming increasingly sophisticated, allowing for more efficient and accurate drilling. This is making drilling services more attractive to mining companies.

Global Mining Drilling Services Market: Challenges

-

Environmental concerns:

Mining operations can have a significant impact on the environment, including soil erosion, water pollution, and air pollution. This has led to increased scrutiny of the mining industry and stricter environmental regulations. Mining drilling services companies must find ways to operate in a more environmentally sustainable way.

-

Skilled labor shortage:

The mining industry is facing a shortage of skilled labor, including drillers, geologists, and engineers. This is making it difficult for mining companies to find the qualified workers they need to operate their mines safely and efficiently. Mining drilling services companies are also facing this challenge, as they need to attract and retain skilled workers in order to compete effectively.

-

Geopolitical instability:

The mining industry is often vulnerable to geopolitical instability, such as war, terrorism, and political unrest. This can disrupt mining operations and make it difficult for mining companies to operate in certain regions. Mining drilling services companies are also exposed to this risk, as they often operate in these same regions.

Global Mining Drilling Services Market: Segmentation

By Mining Type, it is categorized into Coal, Metal, Minerals, Quarry.

By End User, it is divided into Construction, Manufacturing, Technology Industries.

By Region, it is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

Global Mining Drilling Services Market: Regional Insights

The Global Mining Drilling Services Market is segmented into North America, Europe, Asia-Pacific, and the Middle East and Africa (LAMEA). North America is the largest market for mining drilling services, accounting for over XX of the global market in 2022. This is due to the region’s large and well-established mining industry, as well as the presence of major drilling service providers such as Boart Longyear and Halliburton. The market in North America is expected to grow at a CAGR of XX from 2022 to 2030, driven by the increasing demand for minerals such as copper, gold, and lithium. Asia Pacific is the second-largest market for mining drilling services, accounting for over 30% of the global market in 2022. The market in Asia Pacific is expected to grow at a CAGR of XX from 2022 to 2030, driven by the strong growth of the mining industry in China, India, and Indonesia. Europe is the third-largest market for mining drilling services, accounting for over 20% of the global market in 2022. The market in Europe is expected to grow at a CAGR of 4.5% from 2022 to 2030, driven by the increasing demand for minerals such as copper, gold, and zinc.

Global Mining Drilling Services Market: Competitive Landscape

The Global Mining Drilling Services Market is driven by players Byrnecut Group, Ausdrill, Pt United Tractors Tbk, Action Drill & Blast, Boartlongyear and other participants in the value chain are among those not featured in the research.

Global Mining Drilling Services Market: Recent Developments:

- In October 2023, Boart Longyear announced that it had acquired the Australian drilling company, MinEx Services. This acquisition will strengthen Boart Longyear’s position in the Asia-Pacific market.

- In September 2023, Byrnecut Group announced that it had signed a contract with Rio Tinto to provide drilling services at the North West Coastal Pilbara iron ore project in Australia. This contract is worth over USD 1 billion.